Best Expense Tracker Apps for iOS and Android (2022)

Most expense tracking apps let you set up a budget with a clear goal about how much money you wish to save. Once you have created a custom budget based on your spending, the app provides you a clear view of your total spending and also warns you whenever it finds you going overboard with your spending. Spending trackers even allow you to link all of your accounts so that you can manage everything from one spot – without having to hop from one place to another, and spend plenty of unnecessary time. With the bill tracker, it makes sure you remain in the loop about the upcoming bills so that you won’t have to pay a hefty fine. On top of all, these expense tracking apps also provide deep insight to help you sort out your financial mess and boost your saving big time. Now that you have got a fair idea about their modus operandi, let’s get started with the top spending trackers for iOS and Android on the right note!

1. Wally

If an easy-to-use and smart personal finance assistant is what you are looking for, “Wally” is the one I would recommend you to try out. The expense tracker lets you set a budget depending on your goal. And then, it helps you keep a track of each and every expense, ensuring you don’t miss out on the things that matter.

Probably the best part about Wally is the ability to sync all of your accounts and keep a tab on them right from one spot. With a clutter-free dashboard, the expense tracker makes it incredibly straightforward to take a close eye on the account balances. Notably, it provides up to two years of in-depth insights about your spending patterns so that you will be able to figure out the areas that need to be addressed with more attention. The presence of interactive pies, bars, and line charts allow you to dive into every subtle detail and spot the grey areas. Overall, Wally is one of the best expense tracker apps for iOS and Android for managing finance with ease. Key features:

Clutter-free dashboard Ability to sync all of your accounts Two years of in-depth insights Interactive pies, bars, and line charts

Install: iOS and Android (free, offers in-app purchases)

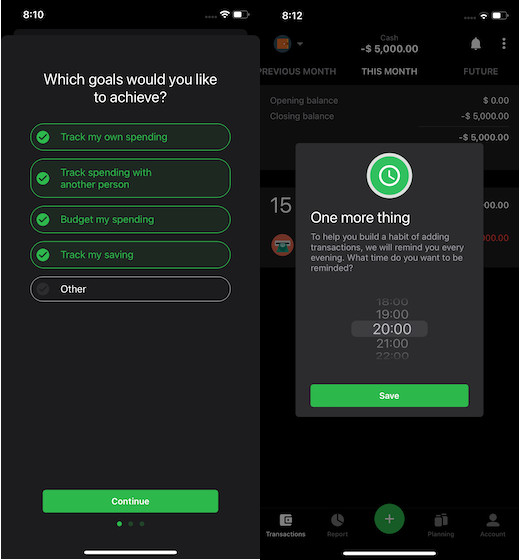

2. Spendee

Spendee is a neat budgeting app that promises to cut down all the unnecessary expenses and enable you to save more money than ever before. And from what I can tell after giving it a shot, I must say that it has got the features to keep an eye on spending and preventing it from going overboard – without breaking any sweat.

The expense tracker features an intuitive interface that is fully customizable. Thus, you can set a budget as per your needs and set the target to achieve at your own pace. Spendee analyzes your expenses and automatically organizes them so that it’s easier to track each spending type. Thanks to the infographics, detailed graphs, and insights, you will be able to get a clear picture of how you are spending your money. What’s more, it features a dark mode so that you can check your expenses without burning your eyes in the night. Key features:

Flexible budget Automatically organizes your expenses Detailed graphs Dark mode

Install: iOS and Android (free, offers in-app purchases)

3. Pocket Expense 6

Should you wish to go for a fully-featured personal finance assistant, Pocket Expense could be the right answer to your needs. For a more simplified expense tracking experience, the app lets you sync all of your accounts and manage them without having to move from one account to the other. With the daily, weekly, monthly, and yearly stats, the app ensures you have a transparent perspective about your spending.

With the recurring and non-recurring budget, it keeps finance management straightforward. Moreover, you can move funds from one budget to another and set custom alerts to never miss the due bills. Thanks to the calendar view, you will be able to glance through essential things with the utmost ease. Pocket Expense also provides a trusted password protection feature to stop unauthorized access. Plus, there is an option to back up all the data and restore it without any pain. To sum up, it’s a highly-rated expense tracker that can play a good part in boosting your finance. Key features:

Reports of all your transactions Password protection Calendar view Reliable backup and restore

Install: iOS (free, offers in-app purchases)

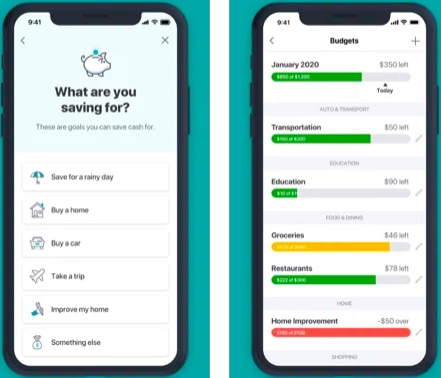

4. Mint

Touted to be the number one personal finance and budgeting app, Mint is second to none when it comes to taking control of expenses. To get going, you can set your financial goal based on your requirements and use the actionable insights to reduce unnecessary spending and save more money than ever before.

Depending on the goal you have set, Mint offers personalized tips to help you nab the culprits and get rid of them. One of my favorite features of this app is the efficient bill tracker that plays a vital role in managing recurring expenses. And with the bill pay reminders, it keeps you in the loop about upcoming bills so that you don’t have to pay a fine. Another notable feature of this app is the money tracker that provides a quick view of your account balances, budgeting, account balances to keep you in complete control. Not to mention, Mint also provides your credit score in order to let you know how well you are performing in the credit department. Key features:

Offers personalized tips Efficient bill tracker Money tracker Provides your credit score Managing recurring expenses

Install: iOS and Android (free, offers in-app purchases)

5. Spending Tracker

While Spending Tracker may not be a feature-packed expense tracking app, it’s got you covered with all the easy-to-use tools that can let you monitor your spending and cut down the not-so-smart expenses. The app has a clean interface and lets you track your spending weekly, monthly, or yearly. Based on your target, you can set a fixed budget and track the spending.

Spending Tracker shows a summary view of all of your spending progress, therefore you can take a quick glance at the expenses without needing to dig deep. It allows straightforward transaction entry and also offers you the flexibility to repeat/export transactions. What I love the most about this app is the option to choose a specific icon for each category, which adds a bit of personal touch to the mix. And with an insightful visualization, it offers a bird’s eye view of how your money is spent. Thus, tracking down the shortcomings to get rid of extra expenses becomes a tad easier. In a nutshell, Spending Tracker is among the top expense tracker apps for Android and iOS. Key features:

Clean interface Flexibility to set a fixed budget Insightful visualization A summary view

Install: iOS and Android (free, offers in-app purchases)

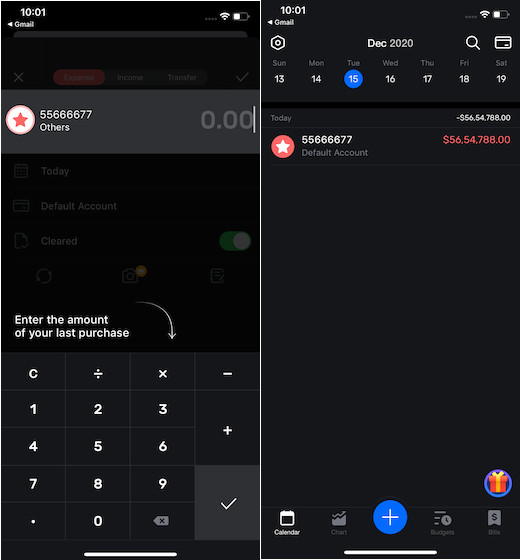

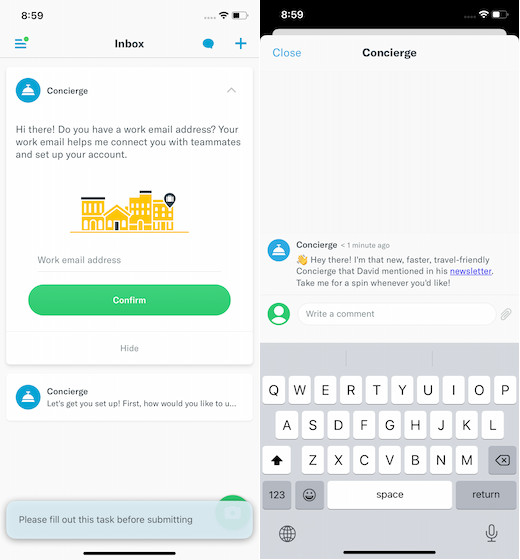

6. Money Lover

If you find budget planning an inconvenient affair, you shouldn’t miss out on Money Lover. The app lets you set up your budget with ease and also create several sub-categories so that you can monitor both extravagant and minor spending.

Courtesy of the tailored advice, it enables you to manage your budget wisely and also track down the things that must be avoided to double down on the saving. Notably, it also features a built-in calculator to help you carry out calculations pretty fast. For a hassle-free tracking of the total spending, Money Lover allows you to link your bank accounts and keep a tab on each transaction right from one spot. With the bank accounts report, it ensures you remain informed about your expenses and in complete control of your money. Even in terms of security, Money Lover is on par tanks to the bank-level security that offers the high-end safeguard to your sensitive information. Key features:

Option to create several sub-categories Hassle-free tracking of the total spending A built-in calculator Bank-level security

Install: iOS and Android (free, offers in-app purchases)

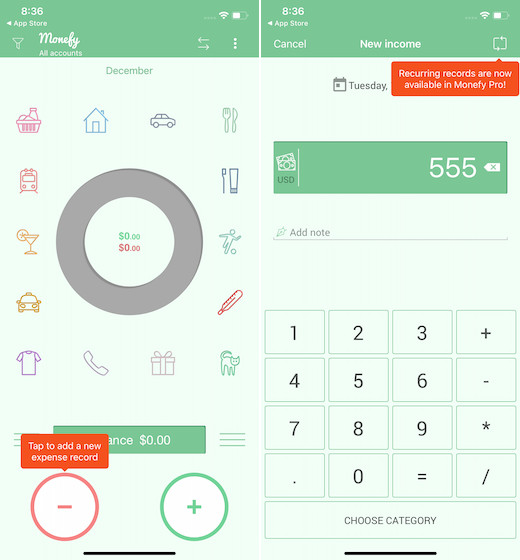

7. Moneyfy

Moneyfy is the sort of expense tracker that seems complete in more ways than one. For starters, the app provides one of the most detailed charts that are designed to offer thorough insight into your spending. So, whether you are willing to bump up your saving or get rid of all the overspending that has been hurting your finance, you can count on it to sort out your financial mess and put things back on track.

Features like tracking recurring records, multiple currency support, and the built-in calculator have got you fully covered. And with the detailed reports, it keeps you in the know about your money spending. Not just that, it also offers pro tips to prevent you from overspending. Furthermore, Moneyfy supports both Google Drive and Dropbox to let you synchronize your data and make it accessible across devices. If you don’t want anyone to get inside the app without your permission, you can enable a strong passcode to ward off unauthorized access. Key features:

Multiple currency support Efficient calculator Supports both Google Drive and Dropbox Detailed reports

Install: iOS and Android (free, offers in-app purchases)

8. Expensify

If you are hunting for more than just a simple expense tracking app for your iOS or Android device, Expensify deserves to get your attention. With Expensify, you can track your business, personal expenses, scan receipts, and even your book travel. Thanks to the integrations with several accounting apps including QuickBooks, Xero, NetSuite, Sage Intacct, and more, it enables you to manage your expenses with better control.

The custom report exports, insightful tracking, and advanced tax reporting play a vital role in keeping you aware of the things that you must do to boost your finance and also nab the downsides that are obstructing it from reaching the full potential. The PCI-compliant security works as the essential safeguard to keep your sensitive information protected from the prying eyes. Putting everything into the right perspective, Expensify is a versatile expense tracking app for Android and iOS. Key features:

Integrations with several accounting apps Custom report exports Advanced tax reporting PCI-compliant security

Install: iOS and Android (free, offers in-app purchases)

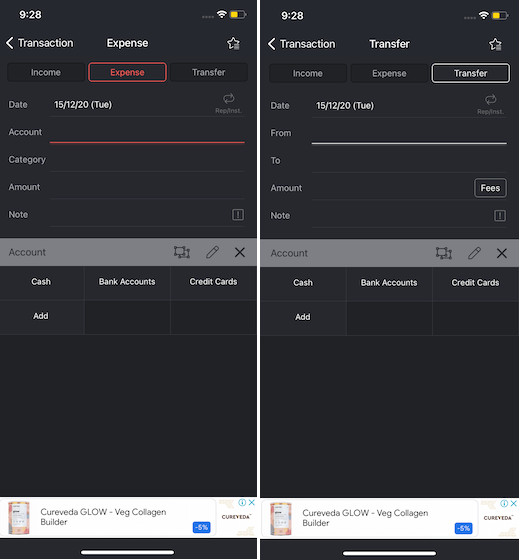

9. Money Manager: Budget&Expense

As someone who prefers a simplified experience, I have found Money Manager up to the mark. There are the reasons why it’s worth giving a serious look. First and foremost, the app features a neat calculator function to let you quickly do your maths. Second, it allows you to manage all of your accounts from one place and also offers the flexibility to set up as many sub-categories as you need.

Third, the Money Manager supports multiple currencies and provides a calendar view of all your set rules. What I have found really handy in this app is the proficient credit card management that allows you to view the payment amount, outstanding balance, and even connect it to your bank accounts to record expenses automatically. Even better, Money Manager sorts expenses by receipt so that you can view the information graphically. And if you never want to lose important data, you would appreciate the useful backup and restore functionality. Key features:

Set up as many sub-categories as you need. Proficient credit card management View the information graphically Back up and restore functionality

Install: iOS and Android (free, offers in-app purchases)

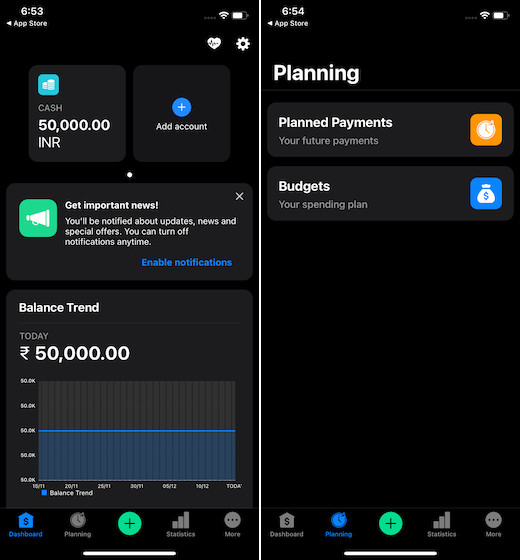

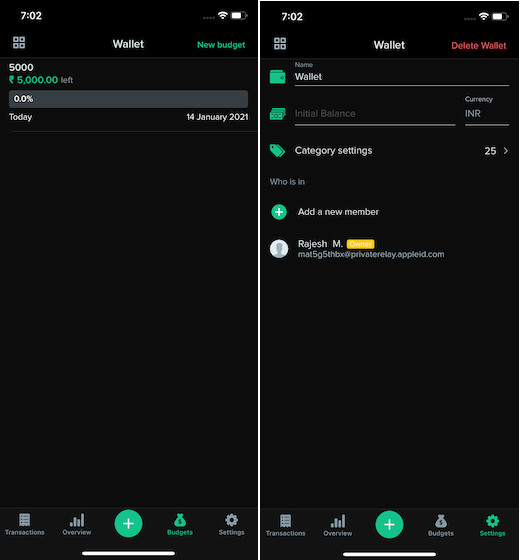

10. Wallet – Daily Budget & Profit

Last but not least, Wallet is a proficient personal finance app that you can use to manage your budget. The app offers a flexible budgeting system to let you set one time or recurring budgets. Based on your needs, you can combine several categories and keep a tab on them. Furthermore, it automatically syncs transactions with your bank and also keeps you in the loop about each update.

Another feature that makes Wallet a great asset is an insightful report with easy-to-use graphs and financial overviews. Thus, you can check out the state of your finances, credit and debit cards, cash, and more. What’s more, Wallet supports multiple currencies and provides a seamless cloud synchronization to keep your data secure and easily accessible across devices. Long story short, Wallet is an able personal finance assistant that can let you manage your spending with the desired control. Key features:

Supports multiple currencies Insightful report Easy-to-use graphs and financial overviews Seamless cloud synchronization

Install: iOS and Android (free, offers in-app purchases)

Top Expense Tracking Apps for iOS and Android (Free and Paid)

So, these are the best spending trackers that can play a vital role in enabling you to manage your expenses with better control. Thanks to in-depth reports and actionable insights, they can keep you fully informed about how your money is spent. And with the pro advice, these expense trackers can also help you find ways to reduce unnecessary spending and bolster saving. By the way, which is your favorite spending tracker? We would be glad to know your favorite personal finance assistant in the comments section below. Besides, if you know any other apps that work well in boosting saving by enhancing finance management, tell us about them as well.

![]()

![]()